Forecasting Equity using LSTM Value-at-Risk Estimation

Main Article Content

Abstract

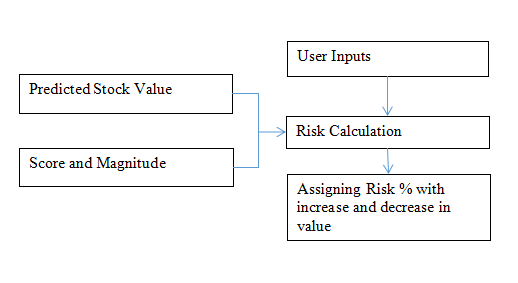

A deep learning hybrid approach (LSTM-VaR) is proposed for risk-based stock value prediction by comparing the relationship and temporal sequence of stock value data. By utilizing time in its predictions, the model can improve accuracy and reduce volatility in stock price projections. It can anticipate changes in stock market indices and develop a reliable strategy for projecting future costs while calculating normal fluctuations of indices.

Article Details

References

J. C. Jackson, J. Prassanna, M. A. Quadir and V. Sivakumar, “Stock market analysis and prediction using time series analysis”, Materials Today: Proceedings, November 2020.

S. Angra and S. Ahuja, “Machine learning and its applications: A Review”, International Conference on Big Data Analytics and Computational Intelligence, Chirala, Andhra Pradesh, India, March 2017.

L. N. Mintarya, J. N. M. Halim, C. Angie, S. Achmad and A. Kurniawan, “Machine learning approaches in stock market prediction: A systematic literature review”, ICCSCI, Procedia Computer Science, pp. 96-102, Jakarta Indonesia, 2023.

N. V. Priya and S. Geetha, “Stock prediction using machine learning techniques”, IJCRT, Vol. 10, Issue 10, October 2022.

S. M. Idrees, M. A. Alam and P. Agarwal, “A prediction approach for stock market volatility based on time series data”, IEEE Access, February 2019.

L. Dongdong, S. Yuan, M. Li and Y. Xiang, “An Empirical Study of Machine Learning Algorithms for Stock Daily Trading Strategy” ,Mathematical Problems in Engineering, April 2019.

X. Yan, W. Weihan and M. Chang, “Research on financial assets transaction prediction model based on LSTM neural network”, Neural Computing and Applications, May 2020.

J. Zhao, D. Zeng, S. Liang, H. Kang and Q. Liu, “Prediction model for stock price trend based on recurrent neural network”, Journal of Ambient Intelligence and Humanized Computing, May 2020.

A. S. Saud and S. Shakya, “Analysis of look back period for stock price prediction with RNN variants: A case study on banking sector of NEPSE”, International Conference on Computational Intelligence and Data Science (ICCIDS), pp. 788-798, 2020.

T. Guo, N. Jamet, V. Betrix, L. A. Piquet and E. Hauptmann, “ESG2Risk: A deep learning framework from ESG news to stock volatility prediction”, arXiv, May 2020.

J. Shen and M. O. Shafiq, “Short?term stock market price trend prediction using a comprehensive deep learning system”, Journal of Big Data, Vol. 7, Issue 1, August 2020.

Yasam, S. ., H. Nair, S. A. ., & Kumar, K. S. . (2023). Machine Learning based Robust Model for Seed Germination Detection and Classification . International Journal of Intelligent Systems and Applications in Engineering, 11(2s), 116–124. Retrieved from https://ijisae.org/index.php/IJISAE/article/view/2515

X. Zhang, S. Liu and X. Zheng, “Stock price movement prediction based on a deep factorization machine and the attention mechanism”, Mathematics, Vol. 9, Issue 8, April 2021.

W. Lu, J. Li, Y. Li, A. Sun and J. Wang, “A CNN-LSTM-based model to forecast stock prices”, Complexity, November 2020.

N. Saurabh, “LSTM-RNN model to predict future stock prices using an efficient optimizer”, IRJET, Vol. 7, Issue 11, November 2020.

Prof. Barry Wiling. (2017). Monitoring of Sona Massori Paddy Crop and its Pests Using Image Processing. International Journal of New Practices in Management and Engineering, 6(02), 01 - 06. https://doi.org/10.17762/ijnpme.v6i02.54

K. Ansah, “Intelligent models for stock price prediction: A comprehensive review”, Journal of Information Technology Research, Vol. 15 Issue 1, 2023.

K. H. Sadia, A. Sharma, A. Paul, S. Padhi and S. Sanyal, “Stock market prediction using machine learning algorithms”, IJEAT, Vol. 8, Issue 4, April 2019.

Jacobs, M., Georgiev, I., ?or?evi?, S., Oliveira, F., & Sánchez, F. Efficient Clustering Algorithms for Big Data Analytics. Kuwait Journal of Machine Learning, 1(3). Retrieved from http://kuwaitjournals.com/index.php/kjml/article/view/138

M. Hiransha, E. A. Gopalakrishnan, V. K. Menon and K. P. Soman, “NSE stock market prediction using deep-learning models”, ICCIDS, Procedia Computer Science, pp. 1351-1362, Haryana, India, 2018.

J. Bi, “Stock market prediction based on financial news text mining and investor sentiment recognition”, Mathematical Problems in Engineering, 2023.

H. H. Htun, M. Biehl and N. Petkov, “Survey of feature selection and extraction techniques for stock market prediction”, Financial Innovation, Vol. 9, Issue 26, 2023.

S. Selvin, R. Vinayakumar, E. A. Gopalakrishnan, V. K. Menon and K. P. Soman, “Stock price prediction using LSTM, RNN and CNN - Sliding Window Model”, ICACCI, Mangalore, India, September 2017.

Z. Su and B. Yi, “Research on HMM-based efficient stock price prediction”, Mobile Information Systems, 2022.

Luca Ferrari, Deep Learning Techniques for Natural Language Translation , Machine Learning Applications Conference Proceedings, Vol 2 2022.

Q. Zhuge, L. Xu and G. Zhang, “LSTM neural network with emotional analysis for prediction of stock price”, Engineering Letters, Vol. 25, Issue 2, pp. 167-175, May 2017.

L. M. Dang, A. Sadeghi-Niaraki, H. D. Huynh, K. Min and H. Moon, “Deep learning approach for short-term stock trends prediction based on two-stream Gated Recurrent Unit network”, IEEE Access, 2018.

Yathiraju, D. . (2022). Blockchain Based 5g Heterogeneous Networks Using Privacy Federated Learning with Internet of Things. Research Journal of Computer Systems and Engineering, 3(1), 21–28. Retrieved from https://technicaljournals.org/RJCSE/index.php/journal/article/view/37

J. Maqbool, P. Aggarwal, R, Kaur, A. Mittal and I. A. Ganaie, “Stock prediction by integrating sentiment scores of financial news and MLP- regressor: A machine learning approach”, ICMLDE, Procedia Computer Science, pp. 1067-1078, Chandigarh, India, 2023.

B. Panwar, G. Dhuriya, S. S. Yadav, P. Johri and N. Gaur, “Stock market prediction using Linear Regression and SVM”, ICACITE, Greater Noida, India, March 2021.