A Framework for Credit Risk Prediction Using the Optimized-FKSVR Machine Learning Classifier

Main Article Content

Abstract

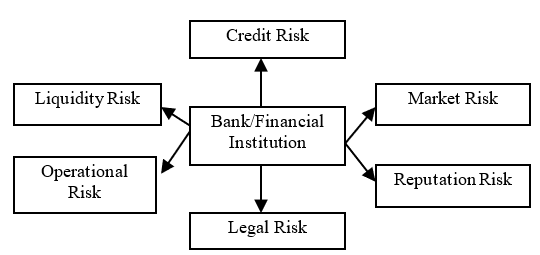

Transparency is influenced by several crucial factors, such as credit risk (CR) predictions, model reliability, efficient loan processing, etc. The emergence of machine learning (ML) techniques provides a promising solution to address these challenges. However, it is the responsibility of banking or nonbanking organizations to control their approach to incorporate this innovative methodology to mitigate human preferences in loan decision-making. The research article presents the Optimized-Feature based Kernel Support Vector Regression (O-FKSVR) model which is an ML-based CR analysis model in the digital banking. This proposal aims to compare several ML methods to identify a precise model for CR assessment using real credit database information. The goal is to introduce a classification model that uses a hybrid of Stochastic Gradient Descent (SGD) and firefly optimization (FFO) methods with Support Vector Regression (SVR) to predict credit risks in the form of probability, loss given, and exposure at defaults. The proposed O-FKSVR model extracts features and predicts outcomes based on data gathered from online credit analysis. The proposed O-FKSVR model has increased the accuracy rate and resolved the existing problems. The experimental study is conducted in Python, and the results demonstrate improvements in accuracy, precision, and reduced error rates compared to previous ML methods. The proposed O-FKSVR model has achieved a maximum accuracy rate value of 0.955%, precision value of 0.96%, and recall value of 0.952%, error rate value of 4.4 when compared with the existing models such as SVR, DT, RF, and AdaBoost.

Article Details

References

Basle Committee on Banking Supervision, and Bank for International Settlements. “Principles for the management of credit risk”, Bank for International Settlements, 2000.

A. H. Mohammad, S. Ghwanmeh, and A. Al-Ibrahim, “Establishing Effective Guidelines to avoid Failure and Reducing Risk in E-Business”, International Journal of Current Engineering and Technology, vol 4, no. 1, pp. 28-31, 2014.

O. Awodele, S. Alimi, O. Ogunyolu, O. Solanke, S. Iyawe, F. Adegbie, F.”Cascade of Deep Neural Network And Support Vector Machine for Credit Risk Prediction”, In 2022 5th Information Technology for Education and Development (ITED), pp. 1-8, IEEE, 2022.

Y. Hu, and J. Su, “Research on credit risk evaluation of commercial banks based on an artificial neural network model”, Procedia Computer Science, vol 199, pp.1168-1176, 2022.

T. G. L. Anwen, and M. S. Bari, “Credit Risk Management and Its Impact on Performance of Commercial Banks: In of Case Ethiopia”, Research Journal of Finance and Accounting, vol 6, no. 24, pp. 53-64, 2015.

C. Jiang, Z. Wang, and H. Zhao, “A prediction-driven mixture cure model and its application in credit scoring”, European Journal of Operational Research, vol 277, no. 1, pp. 20-31, 2019.

W. Liu, H. Fan, and M. Xia, “Credit scoring based on tree-enhanced gradient boosting decision trees”, Expert Systems with Applications, vol 189, pp. 116034, 2022.

W. Zhang, D. Yang, and S. Zhang, “A new hybrid ensemble model with voting-based outlier detection and balanced sampling for credit scoring”, Expert Systems with Applications, vol 174, pp. 114744, 2021.

S. Goyal, N. Batra, K. Chhabra, “Diabetes Disease Diagnosis Using Machine Learning Approach”, Lecture Notes in Networks and Systems, vol 473, pp 229–237, 2023.

Poonam, N. Batra, “Evaluation of Various Machine Learning Based Existing Stress Prediction Support Systems (SPSSs) for COVID-19 Pandemic”, Communications in Computer and Information Science, vol 1798 CCIS, pp. 408–422, 2023.

N. Batra, S. Goyal, “Real-Time Smart Traffic Analysis Employing a Dual Approach Based on AI”, Lecture Notes in Networks and Systems, vol 600, pp. 713–723, 2023.

S. Goyal, N. Batra, K. Chhabra, “Lung Disease Detection Using Machine Learning Approach”, “Lecture Notes in Networks and Systems, vol 473, pp. 251–260, 2023.

Ipseeta Nanda, Monika SIngh, Lizina Khatua. (2023). Automated Irrigation System Using IoT Cloud Computing. International Journal of Intelligent Systems and Applications in Engineering, 11(2s), 360–365. Retrieved from https://ijisae.org/index.php/IJISAE/article/view/2728

A. Ampountolas, “A machine learning approach for Micro-Credit scoring, MDPI. Multidisciplinary Digital Publishing Institute”, Available at: https://www.mdpi.com/2227-9091/9/3/50 (Accessed: April 4, 2023), 2021.

Ms. Elena Rosemaro. (2014). An Experimental Analysis Of Dependency On Automation And Management Skills. International Journal of New Practices in Management and Engineering, 3(01), 01 - 06. Retrieved from http://ijnpme.org/index.php/IJNPME/article/view/25

T. N. Pandey, A. K. Jagadev, S. K. Mohapatra, and S. Dehuri,” Credit risk analysis using machine learning classifiers”, In 2017 International Conference on Energy, Communication, Data Analytics and Soft Computing (ICECDS) (pp. 1850-1854). IEEE,2017.

Y. Hu, and I. Su, “Research on credit risk evaluation of commercial banks based on artificial neural network model”, Procedia Computer Science, vol 199, pp. 1168-1176, 2022.

Condori-Alejo, H. I., Aceituno-Rojo, M. R., and G. S. Alzamora, “Rural micro credit assessment using machine learning in a peruvian microfinance institution”, Procedia Computer Science, vol 187, pp. 408-413, 2021.

E. Dri, A. Aita, E. Giusto, D. Ricossa, D. Corbelletto, B. Montrucchio, and R. Ugoccioni, “A More General Quantum Credit Risk Analysis Framework”, Entropy, vol 25, no. 4, pp. 593, 2023.

G. S. Alzamora, M. R. Aceituno-Rojo, and H. I. Condori-Alejo, “An Assertive Machine Learning Model for Rural Micro Credit Assessment in Peru”, Procedia Computer Science, vol 202, pp.301-306, 2022.

J. Li, C. Xu, B. Feng, and H. Zhao, “Credit Risk Prediction Model for Listed Companies Based on CNN-LSTM and Attention Mechanism”, Electronics, vol 12, no. 7, 1643, 2023.

L. Wang, F. Jia, L. Chen, and Q. Xu, “Forecasting SMEs’ credit risk in supply chain finance with a sampling strategy based on machine learning techniques”, Annals of Operations Research, pp. 1-33,2022.

Davis, W., Wilson, D., López, A., Gonzalez, L., & González, F. Automated Assessment and Feedback Systems in Engineering Education: A Machine Learning Approach. Kuwait Journal of Machine Learning, 1(1). Retrieved from http://kuwaitjournals.com/index.php/kjml/article/view/102

Z. Huang, Z. Yan, Q. Zhao, and K. Ma, “Credit risk assessment in bank based on SMEs using PCA”, In Journal of Physics: Conference Series (Vol. 1848, No. 1, p. 012071). IOP Publishing, 2021.

Y. Tian, Y. Zhang, and H. Zhang, “Recent Advances in Stochastic Gradient Descent in Deep Learning”, Mathematics, vol 11, no. 3, pp. 682, 2023.

Z. Hassani, M. Alambardar Meybodi, and V. Hajihashemi, “Credit risk assessment using learning algorithms for feature selection”, Fuzzy Information and Engineering, vol 12, no. 4,pp. 529-544, 2020.

B. Huang, Z. Cai, Q. Gu, and C. Chen, “Using Support Vector Regression for Classification”, In Advanced Data Mining and Applications: 4th International Conference, ADMA 2008, Chengdu, China Proceedings 4, pp. 581-588. Springer Berlin Heidelberg, 2008.

Karthickaravindan, “Decision trees and Random Forest”, Kaggle. Kaggle. Available at: https://www.kaggle.com/code/karthickaravindan/decision-trees-and-random-forest/notebook (Accessed: April 26, 2023), 2018.