Design and Performance Study of Improved Fuzzy System with Genetic Algorithm

Main Article Content

Abstract

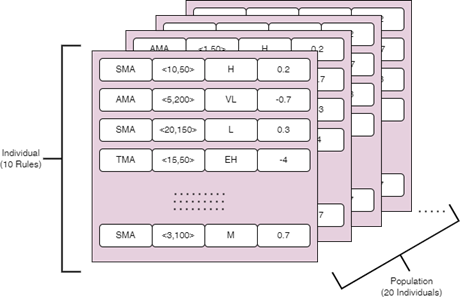

Technical trading relies heavily on analysis, most of which is statistical in nature. When the data to be modeled is nonlinear, imprecise, or complicated, fuzzy inference systems (FISs) are used in conjunction with computational, mathematical, and statistical modeling methodologies to simulate technical trading. Fuzzy logic may be modeled using linear, nonlinear, geometric, dynamic, and integer programming. These techniques, when combined with fuzzy logic, help the decision-maker arrive at a better solution while still facing some degree of ambiguity or uncertainty. The moving average method is a useful metric that may give trade recommendations to aid investors further. While trading signals inform investors of when to purchase and sell, a simple moving average provides no such information. In this research, we suggest a fuzzy moving average approach in which the intensity of trading signals, measured in terms of trading volume, is determined by using the fuzzy logic rule. In this research, we propose using fuzzy logic technical trading rules, which are more resistant to decision-making mistakes, to mitigate the trading uncertainty inherent in the conventional technical indicators method.

Article Details

References

L. A. Zadeh, “Fuzzy logic—a personal perspective,” Fuzzy Sets Syst, vol. 281, pp. 4– 20, Dec. 2015, doi: 10.1016/J.FSS.2015.05.009.

K. Mittal, A. Jain, K. S. Vaisla, O. Castillo, and J. Kacprzyk, “A comprehensive review on type 2 fuzzy logic applications: Past, present and future,” Eng Appl Artif Intell, vol. 95, p. 103916, Oct. 2020, doi: 10.1016/J.ENGAPPAI.2020.103916.

R. G. Tiwari, A. Pratap Srivastava, G. Bhardwaj, and V. Kumar, “Exploiting UML Diagrams for Test Case Generation: A Review,” in Proceedings of 2021 2nd International Conference on Intelligent Engineering and Management, ICIEM 2021, 2021. doi: 10.1109/ICIEM51511.2021.9445383.

A. T. Nguyen, T. Taniguchi, L. Eciolaza, V. Campos, R. Palhares, and M. Sugeno, “Fuzzy control systems: Past, present and future,” IEEE Comput Intell Mag, vol. 14, no. 1, pp. 56–68, Feb. 2019, doi: 10.1109/MCI.2018.2881644.

W. Pedrycz and M. Reformat, “Evolutionary Fuzzy Modeling,” IEEE Transactions on Fuzzy Systems, vol. 11, no. 5, pp. 652–665, Oct. 2003, doi: 10.1109/TFUZZ.2003.817853.

S. Hansun, “A new approach of moving average method in time series analysis,” 2013 International Conference on New Media Studies, CoNMedia 2013, 2013, doi: 10.1109/CONMEDIA.2013.6708545.

R. Reghunath, T. R. S. Murthy, and B. R. Raghavan, “Time Series Analysis to Monitor and Assess Water Resources: A Moving Average Approach,” Environmental Monitoring and Assessment 2005 109:1, vol. 109, no. 1, pp. 65–72, Oct. 2005, doi: 10.1007/S10661-005-5838-4.

I. Svetunkov and F. Petropoulos, “Old dog, new tricks: a modelling view of simple moving averages,” Int J Prod Res, vol. 56, no. 18, pp. 6034–6047, Sep. 2017, doi: 10.1080/00207543.2017.1380326.

V. Alevizakos, K. Chatterjee, C. Koukouvinos, and A. Lappa, “A double moving average control chart: Discussion,” Communications in Statistics-Simulation and Computation, vol. 51, no. 10, pp. 1–15, 2020, doi: 10.1080/03610918.2020.1788591.

Juan Garcia, Guðmundsdóttir Anna, Johansson Anna, Maria Jansen, Anna Wagner. Machine Learning for Predictive Maintenance and Decision Making in Manufacturing. Kuwait Journal of Machine Learning, 2(4). Retrieved from http://kuwaitjournals.com/index.php/kjml/article/view/212

P. Weng, K. Wei, T. Chen, M. Chen, and G. Liu, “Fuzzy Approximate Entropy of Extrema Based on Multiple Moving Averages as a Novel Approach in Obstructive Sleep Apnea Screening,” IEEE J Transl Eng Health Med, vol. 10, 2022, doi: 10.1109/JTEHM.2022.3197084.

B. Billah, M. L. King, R. D. Snyder, and A. B. Koehler, “Exponential smoothing model selection for forecasting,” Int J Forecast, vol. 22, no. 2, pp. 239–247, Apr. 2006, doi: 10.1016/J.IJFORECAST.2005.08.002.

A. Sohail, “Genetic Algorithms in the Fields of Artificial Intelligence and Data Sciences,” Annals of Data Science 2021, pp. 1–12, Aug. 2021, doi: 10.1007/S40745- 021-00354-9.

R. Tiwari, M. Husain, S. Gupta, and A. Srivastava, “Improving ant colony optimization algorithm for data clustering,” in ICWET 2010 - International Conference and Workshop on Emerging Trends in Technology 2010, Conference Proceedings, 2010. doi: 10.1145/1741906.1742026.

S. Katoch, S. S. Chauhan, and V. Kumar, “A review on genetic algorithm: past, present, and future,” Multimed Tools Appl, vol. 80, no. 5, pp. 8091–8126, Feb. 2021, doi: 10.1007/S11042-020-10139-6/FIGURES/8.

S. Mirjalili, “Genetic algorithm,” Studies in Computational Intelligence, vol. 780, pp. 43–55, 2019, doi: 10.1007/978-3-319-93025-1_4/COVER.

M. Abd Elaziz, A. A. Ewees, and Z. Alameer, “Improving Adaptive Neuro-Fuzzy Inference System Based on a Modified Salp Swarm Algorithm Using Genetic Algorithm to Forecast Crude Oil Price,” Natural Resources Research 2019 29:4, vol. 29, no. 4, pp. 2671–2686, Nov. 2019, doi: 10.1007/S11053-019-09587-1.

S. Kumar Chandar, “Fusion model of wavelet transform and adaptive neuro fuzzy inference system for stock market prediction,” Journal of Ambient Intelligence and Humanized Computing 2019, pp. 1–9, Feb. 2019, doi: 10.1007/S12652-019-01224-2.

H. Chung and K. S. Shin, “Genetic Algorithm-Optimized Long Short-Term Memory Network for Stock Market Prediction,” Sustainability 2018, Vol. 10, Page 3765, vol. 10, no. 10, p. 3765, Oct. 2018, doi: 10.3390/SU10103765.

E. Chong, C. Han, and F. C. Park, “Deep learning networks for stock market analysis and prediction: Methodology, data representations, and case studies,” Expert Syst Appl, vol. 83, pp. 187–205, Oct. 2017, doi: 10.1016/J.ESWA.2017.04.030.

O. B. Sezer, M. Ozbayoglu, and E. Dogdu, “A Deep Neural-Network Based Stock Trading System Based on Evolutionary Optimized Technical Analysis Parameters,” Procedia Comput Sci, vol. 114, pp. 473–480, Jan. 2017, doi: 10.1016/J.PROCS.2017.09.031.

R. G. Tiwari, A. K. Agarwal, R. K. Kaushal, and N. Kumar, “Prophetic Analysis of Bitcoin price using Machine Learning Approaches,” in Proceedings of IEEE International Conference on Signal Processing, Computing and Control, 2021, vol. 2021-Octob. doi: 10.1109/ISPCC53510.2021.9609419.

A. Yoshihara, K. Fujikawa, K. Seki, and K. Uehara, “Predicting Stock Market Trends by Recurrent Deep Neural Networks,” pp. 759–769, 2014, doi: 10.1007/978-3-319- 13560-1_60.

X. Ding, Y. Zhang, T. Liu, and J. Duan, “Deep Learning for Event-Driven Stock Prediction,” Twenty-Fourth International Joint Conference on Artificial Intelligence, Jun. 2015, Accessed: Nov. 28, 2022. [Online]. Available: https://www.aaai.org/ocs/index.php/IJCAI/IJCAI15/paper/view/11031

“NYMEX Futures Prices.” https://www.eia.gov/dnav/pet/pet_pri_fut_s1_d.htm (accessed Nov. 28, 2022).