Crude Oil Cost Forecasting using Variants of Recurrent Neural Network

Main Article Content

Abstract

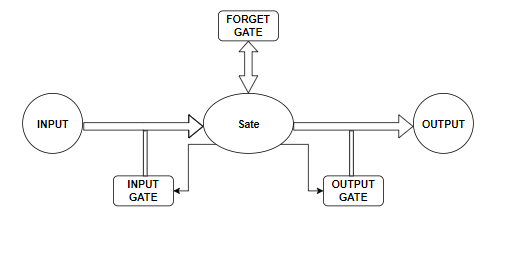

Crude oil cost plays very important role in the country’s economic growth. It is having close impact on economical stability of nation. Because of these reasons it is very important to have accurate oil forecasting system. Due to impact of different factors oil cost data is highly nonlinear and in fluctuated manner. Performing prediction on those data using data driven approaches is very complex task which require lots of preprocessing of data. Working on such a non-stationary data is very difficult. This research proposes recurrent neural network (RNN) based approaches such as simple RNN, deep RNN and RNN with LSTM. To compare performance of RNN variants this research has also implemented Naive forecast and Sequential ANN methods. Performance of all these models are evaluated based on root mean square error(RMSE), mean absolute error(MAE) and mean absolute percentage error(MAPE). The experimental result shows that RNN with LSTM is more accurate compare to all other models. Accuracy of LSTM is more than 96% for the dataset of U.S. Energy Information administration from March 1983 to June 2022. On the basis of experimental result, we come to the conclusion that RNN with LSTM is best suitable for time series data which is highly nonlinear.

Article Details

References

J. L. Zhang, Y. J Zhang, and L. Zhang, “A novel hybrid method for crude oil price forecasting,” Energy Economics, vol.49, pp.649–659,2015, https://doi.org/10.1016/j.eneco.2015.02.018.

K. Lang and B.R. Auer, “The economic and financial properties of crude oil: A review,” The North American Journal of Economics and Finance, vol.52, 2020, https://doi.org/10.1016/j.najef.2019.01.011.

A. Shabri and R. Samsudin, “Daily Crude Oil Price Forecasting Using Hybridizing Wavelet and Artificial Neural Network Model,” Mathematical Problems in Engineering, pp.1–10,2014, https://doi.org/10.1155/2014/201402.

Y. Liu, Z. Li, Y. Yao, and H. Dong, “Asymmetry of Risk Evolution in Crude Oil Market: From the Perspective of Dual Attributes of Oil. Energies,” vol.14,2021, https://doi.org/10.3390/en14134063.

G. Dave, R. ., & Thankachan, D. . (2023). Elastic Optical Networks Based Optimization Using Machine Learning: State-Of-Art Review. International Journal of Intelligent Systems and Applications in Engineering, 11(3s), 218–223. Retrieved from https://ijisae.org/index.php/IJISAE/article/view/2564

E. Olamide, K. Ogujiuba, and A. Maredza, “Exchange Rate Volatility, Inflation and Economic Growth in Developing Countries: Panel Data Approach for SADC,” Economies, vol.10,2022, https://doi.org/10.3390/economies10030067.

Y. Zhao, J. Li, and L. Yu, “A deep learning ensemble approach for crude oil price forecasting,” Energy Economics, vol.66, pp. 9–16 ,2017, https://doi.org/10.1016/j.eneco.2017.05.023.

H. Chiroma, S. Abdulkareem, and T. Herawan, “Evolutionary Neural Network model for West Texas Intermediate crude oil price prediction,” Applied Energy, vol. 142, pp. 266–273,2015, https://doi.org/10.1016/j.apenergy.2014.12.045.

M. Mostafa and A. El-Masry, “Oil price forecasting using gene expression programming and artificial neural networks,” Economic Modelling, vol.54, pp. 40–53,2016, https://doi.org/10.1016/j.econmod.2015.12.014.

M.R. Mahdiani and E. Khamehchi, “A modified neural network model for predicting the crude oil price,” Intellectual Economics, vol.10, pp.71–77,2016, https://doi.org/10.1016/j.intele.2017.02.001.

Y. Ding, “A novel decompose-ensemble methodology with AIC-ANN approach for crude oil forecasting,” Energy, vol.154, pp.328–33 ,2018, https://doi.org/10.1016/j.energy.2018.04.133.

Prof. Madhuri Zambre. (2016). Automatic Vehicle Over speed Controlling System using Microcontroller Unit and ARCAD. International Journal of New Practices in Management and Engineering, 5(04), 01 - 05. Retrieved from http://ijnpme.org/index.php/IJNPME/article/view/47

L. Yu, W. Dai, and L. Tang, “A novel decomposition ensemble model with extended extreme learning machine for crude oil price forecasting,” Engineering Applications of Artificial Intelligence, vol. 47, pp. 110–121,2016, https://doi.org/10.1016/j.engappai.2015.04.016.

R. Tehrani.,” A hybrid optimized artificial intelligent model to forecast crude oil using genetic algorithm,” African journal of business management, vol.5,2011, https://doi.org/10.5897/AJBM11.304.

H. Shin, T. Hou, K. Park, C. Park, and S. Choi, “Prediction of movement direction in crude oil prices based on semi-supervised learning,” Decision Support Systems, vol.55, pp. 348–358,2013, https://doi.org/10.1016/j.dss.2012.11.009.

Y. Chen, K. He, and G. Tso, “Forecasting Crude Oil Prices: A Deep Learning based Model,” Procedia Computer Science, vol.122, pp.300–307,2017, https://doi.org/10.1016/j.procs.2017.11.373.

H. Wang, F. Zhang, X. Xie, and M. Guo, “Deep knowledge-aware network for news recommendation”, Proceedings of the 2018 World Wide Web Conference on World Wide Web - WWW ’18, pp.1835–1844,2018, https://doi.org/10.1145/3178876.3186175.

X.Ma, Y. Jin, and Q. Dong, “A generalized dynamic fuzzy neural network based on singular spectrum analysis optimized by brain storm optimization for short-term wind speed forecasting,” Applied Soft Computing, vol.54, pp.296–312 ,2017, https://doi.org/10.1016/j.asoc.2017.01.033.

J. Wang, X. Li, T. Hong, and S. Wang, “A semi-heterogeneous approach to combining crude oil price forecasts,” Information Sciences, vol.460–461, pp. 279–292,2018, https://doi.org/10.1016/j.ins.2018.05.026.

Martinez, M., Davies, C., Garcia, J., Castro, J., & Martinez, J. Machine Learning-Enabled Quality Control in Engineering Manufacturing. Kuwait Journal of Machine Learning, 1(2). Retrieved from http://kuwaitjournals.com/index.php/kjml/article/view/122

L.Yan, Y. Zhu, and H. Wang, “Selection of Machine Learning Models for Oil Price Forecasting: Based on the Dual Attributes of Oil,” Discrete Dynamics in Nature and Society, pp.1-16,2021, https://doi.org/10.1155/2021/1566093.

I.SenGupta, W. Nganje, and E. Hanson, “Refinements of Barndorff-Nielsen and Shephard Model: An Analysis of Crude Oil Price with Machine Learning,” Annals of Data Science, vol.8(1), pp.39–55,2021, https://doi.org/10.1007/s40745-020-00256-2.

J. Wang, H. Zhou, T. Hong, X. Li, and S. Wang, “A multi-granularity heterogeneous combination approach to crude oil price forecasting,” Energy Economics, vol.91, 2020, https://doi.org/10.1016/j.eneco.2020.104790.

D.Rapach and G. Zhou, “Time?series and Cross?sectional Stock Return Forecasting: New Machine Learning Methods,” Machine Learning for Asset Management, pp. 1–33,2020, https://doi.org/10.1002/9781119751182.ch1.

Q. Lu, S. Sun, H. Duan, and S. Wang, “Analysis and forecasting of crude oil price based on the variable selection-LSTM integrated model,” Energy Informatics, vol.4, 2021, https://doi.org/10.1186/s42162-021-00166-4.

C.Deng, L. Ma, and T. Zeng, “Crude Oil Price Forecast Based on Deep Transfer Learning: Shanghai Crude Oil as an Example,” Sustainability, vol.13(24), 2021, https://doi.org/10.3390/su132413770.

A. Daneshvar, M. Ebrahimi, F. Salahi, M. Rahmaty, and M. Homayounfar, “Brent Crude Oil Price Forecast Utilizing Deep Neural Network Architectures,” Computational Intelligence and Neuroscience,pp.1-13,2022, https://doi.org/10.1155/2022/6140796.

J. Hu, Y. Hu, and R. Lin, “Applying Neural Networks to Prices Prediction of Crude Oil Futures,” Mathematical Problems in Engineering, pp.1-12,2012, https://doi.org/10.1155/2012/959040.