Role of Blockchain Technology Integration for Green Bonds Issuance with Sustainability Aspect

Main Article Content

Abstract

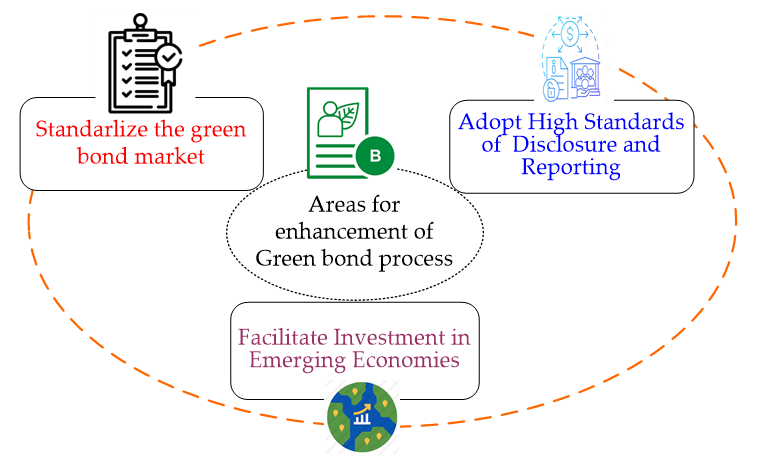

Green bonds have gained significant attention in supporting sustainable development goals for achieving sustainability. During the issuance of green bonds, there are a few concerns such as standardization, greenwashing, and lack of benefits that can be gained with green bonds. However, blockchain technology is a promising solution for green bond issuance because it has already shown its impact on different finance activities. This study aims to address and analyze the role and significance of green bond issuance for meeting sustainability with blockchain technology and also suggested recommendations for future research. Decentralized application based on the Algorand blockchain and high-level architecture proposed for the issuance of green bonds is at the primary level. There is no discussion regarding standardizing the environmental data, and the number of benefits gained by the green bond is not addressed in the previously published literature. From the analysis, it has been identified that a similar framework of blockchain cannot be implemented as the geographical and environmental parameters are quite different for every nation. So, every nation needs to customize the framework according to the nation's requirements. This study is the first attempt to combine information from previously published research about green bond issuance and integration of blockchain for green bond issuance, enlightening the disruption caused in the issuance of green.

Article Details

References

“SDG 7: Affordable And Clean Energy.” https://in.one.un.org/page/sustainable-development-goals/sdg-7/ (accessed Jan. 19, 2022).

“SDG 9: Industry, Innovation And Infrastructure.” https://in.one.un.org/page/sustainable-development-goals/sdg-9/ (accessed Jun. 03, 2022).

“THE 17 GOALS | Sustainable Development.” https://sdgs.un.org/goals (accessed Dec. 28, 2020).

E. Seyedsayamdost, “Sustainable development goals,” Essent. Concepts Glob. Environ. Gov., pp. 251–253, 2020, doi: 10.5005/jp/books/13071_5.

S. V. Akram et al., “Blockchain Enabled Automatic Reward System in Solid Waste Management,” Secur. Commun. Networks, vol. 2021, 2021.

“The Paris Agreement | UNFCCC.” https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed Oct. 20, 2022).

S. R. Foster and C. Iaione, “Ostrom in the city: Design principles and practices for the urban commons,” in Routledge Handbook of the Study of the Commons, Routledge, 2019, pp. 235–255.

J. C. Reboredo, “Green bond and financial markets: Co-movement, diversification and price spillover effects,” Energy Econ., vol. 74, pp. 38–50, 2018.

P. Krueger, Z. Sautner, and L. T. Starks, “The importance of climate risks for institutional investors,” Rev. Financ. Stud., vol. 33, no. 3, pp. 1067–1111, 2020.

A. Bhattacharya, C. Contreras, M. Jeong, A.-L. Amin, G. Watkins, and M. Silva, “Attributes and Framework for Sustainable Infrastructure,” Idb, p. 49, 2019, [Online]. Available: https://publications.iadb.org/en/attributes-and-framework-sustainable-infrastructure

T. Nitlarp and S. Kiattisin, “The Impact Factors of Industry 4.0 on ESG in the Energy Sector,” Sustain., vol. 14, no. 15, 2022, doi: 10.3390/su14159198.

A. Poberezhna, “Addressing water sustainability with blockchain technology and green finance,” in Transforming climate finance and green investment with blockchains, Elsevier, 2018, pp. 189–196.

Y. Chen and U. Volz, “Scaling up sustainable investment through blockchain-based project bonds,” ADB-IGF Spec. Work. Pap. Ser. “Fintech to Enable Dev. Investment, Financ. Inclusion, Sustain., 2021.

M. Janssen, V. Weerakkody, E. Ismagilova, U. Sivarajah, and Z. Irani, “A framework for analysing blockchain technology adoption: Integrating institutional, market and technical factors,” Int. J. Inf. Manage., vol. 50, pp. 302–309, 2020.

S. V. Akram, P. K. Malik, R. Singh, G. Anita, and S. Tanwar, “Adoption of blockchain technology in various realms: Opportunities and challenges,” Secur. Priv., vol. 3, no. 5, pp. 1–17, 2020, doi: 10.1002/spy2.109.

G. Cortellini and I. C. Panetta, “Green Bond: A Systematic Literature Review for Future Research Agendas,” J. Risk Financ. Manag., vol. 14, no. 12, p. 589, 2021, doi: 10.3390/jrfm14120589.

V. Malamas, T. Dasaklis, V. Arakelian, and G. Chondrokoukis, “A Block-Chain Framework for Increased Trust in Green Bonds Issuance,” SSRN Electron. J., 2020, doi: 10.2139/ssrn.3693638.

P. Deschryver and F. de Mariz, “What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market?,” J. Risk Financ. Manag., vol. 13, no. 3, p. 61, 2020, doi: 10.3390/jrfm13030061.

G. Katten, “Issuing Green Bonds on the Algorand Blockchain,” 2021, [Online]. Available: http://arxiv.org/abs/2108.10344

K. J. Lee and H. Jeong, “A Framework for Digitizing Green Bond Issuance to Reduce Information Asymmetry,” in Green Digital Finance and Sustainable Development Goals, Springer, 2022, pp. 309–327.

S. Pearson et al., “Are distributed ledger technologies the panacea for food traceability?,” Glob. Food Sec., vol. 20, pp. 145–149, 2019.

V. P. Guidelines et al., “Green bonds - A bridge to the SDGs,” Clim. Bond. Initiat., vol. 1, no. June, p. 8, 2018, [Online]. Available: https://www.icmagroup.org/green-social-and-sustainability-bonds/green-bond-principles-gbp/%0Ahttp://pubdocs.worldbank.org/en/768111536944473808/WB-Green-Bond-Proceeds-Management-and-Reporting-Guide.pdf%0Ahttp://www.un.org/sustainabledevelopment/sustainabl

M. Filkova, C. Frandon-Martinez, and A. Giorgi, “Green Bonds: The State of the Market 2018,” Clim. Bond. Initiat., pp. 1–28, 2018.

I. Shishlov, R. Morel, and I. Cochran, “Beyond transparency: unlocking the full potential of green bonds,” Inst. Clim. Econ., vol. 2016, pp. 1–28, 2016.

B. Hachenberg and D. Schiereck, “Are green bonds priced differently from conventional bonds?,” J. Asset Manag., vol. 19, no. 6, pp. 371–383, 2018.

J. Kochetygova and A. Jauhari, “Climate change, green bonds and index investing: the new frontier,” Retrieved, vol. 20, p. 2017, 2014.

J. Freytag, “CHALLENGES FOR GREEN FINANCE IN INDIA An Analysis of Deficiencies in India’s Green Financial Market,” UMEA Univ., 2020, [Online]. Available: https://www.diva-portal.org/smash/get/diva2:1532467/FULLTEXT01.pdf

A. Chaudhary, V. N. Tiwari, and A. Kumar, “A new intrusion detection system based on soft computing techniques using neuro-fuzzy classifier for packet dropping attack in manets,” Int. J. Netw. Secur., vol. 18, no. 3, pp. 514–522, 2016.

C. Anh Tu, T. Sarker, and E. Rasoulinezhad, “Factors Influencing the Green Bond Market Expansion: Evidence from a Multi-Dimensional Analysis,” J. Risk Financ. Manag., vol. 13, no. 6, p. 126, Jun. 2020, doi: 10.3390/JRFM13060126.

M. Doran and J. Tanner, “Critical challenges facing the green bond market,” Int. Financ. Law Rev., pp. 22–25, 2019, [Online]. Available: https://www.bakermckenzie.com/-/media/files/insight/publications/2019/09/iflr--green-bonds-(002).pdf?la=en

E. S. Sartzetakis, “Green bonds as an instrument to finance low carbon transition,” Econ. Chang. Restruct., vol. 54, no. 3, pp. 755–779, 2021.

F. Casino, T. K. Dasaklis, and C. Patsakis, “A systematic literature review of blockchain-based applications: Current status, classification and open issues,” Telemat. informatics, vol. 36, pp. 55–81, 2019.

Z. Zheng, S. Xie, H. Dai, X. Chen, and H. Wang, “An overview of blockchain technology: Architecture, consensus, and future trends,” in 2017 IEEE international congress on big data (BigData congress), 2017, pp. 557–564.

P. Mukherjee and C. Pradhan, “Blockchain 1.0 to blockchain 4.0—The evolutionary transformation of blockchain technology,” in Blockchain technology: applications and challenges, Springer, 2021, pp. 29–49.

J. Xie et al., “A survey of blockchain technology applied to smart cities: Research issues and challenges,” IEEE Commun. Surv. Tutorials, vol. 21, no. 3, pp. 2794–2830, 2019.

A. Chaudhary, V. Tiwari, and A. Kumar, “A novel intrusion detection system for ad hoc flooding attack using fuzzy logic in mobile ad hoc networks,” in International Conference on Recent Advances and Innovations in Engineering (ICRAIE-2014), 2014, pp. 1–4.

Y. Chen and C. Bellavitis, “Blockchain disruption and decentralized finance: The rise of decentralized business models,” J. Bus. Ventur. Insights, vol. 13, p. e00151, 2020.

W. Cai, Z. Wang, J. B. Ernst, Z. Hong, C. Feng, and V. C. M. Leung, “Decentralized Applications: The Blockchain-Empowered Software System,” IEEE Access, vol. 6, pp. 53019–53033, 2018, doi: 10.1109/ACCESS.2018.2870644.

A. Murray, S. Kuban, M. Josefy, and J. Anderson, “Contracting in the smart era: The implications of blockchain and decentralized autonomous organizations for contracting and corporate governance,” Acad. Manag. Perspect., vol. 35, no. 4, pp. 622–641, 2021.

H. Baber, “Blockchain-based crowdfunding,” in Blockchain Technology for Industry 4.0, Springer, 2020, pp. 117–130.

M. Chanson, N. Martens, and F. Wortmann, “The Role of User-Generated Content in Blockchain-Based Decentralized Finance,” ECIS 2020 Proc., 2020.

O. Sanderson, “How to trust green bonds: Blockchain, climate, and the institutional bond markets,” in Transforming climate finance and green investment with blockchains, Elsevier, 2018, pp. 273–288.

R. Shankar, “Potential of Blockchain Based Tokenized Securities for Green Real Estate Bonds,” in Infrastructure Development–Theory, Practice and Policy, Routledge, 2022, pp. 88–99.

R. On and I. Oxygen, “Gateway for sustainability”.

H. Workie and K. Jain, “Distributed ledger technology: Implications of blockchain for the securities industry,” J. Secur. Oper. Custody, vol. 9, no. 4, pp. 347–355, 2017.

L. J. Cohen, Broken Bonds: Yugoslavia’s disintegration and Balkan politics in Transition. Routledge, 2018.

M. Kouhizadeh and J. Sarkis, “Blockchain practices, potentials, and perspectives in greening supply chains,” Sustainability, vol. 10, no. 10, p. 3652, 2018.

A. F. B, “Advances in Intelligent Networking and Collaborative Systems,” vol. 23, pp. 170–182, 2019, doi: 10.1007/978-3-319-98557-2.

D. Bumblauskas, A. Mann, B. Dugan, and J. Rittmer, “A blockchain use case in food distribution: Do you know where your food has been?,” Int. J. Inf. Manage., vol. 52, p. 102008, 2020.

V. Malamas, T. Dasaklis, V. Arakelian, and G. Chondrokoukis, “A Block-Chain Framework for Increased Trust in Green Bonds Issuance,” Available SSRN 3693638, 2020.

S. Wang, L. Ouyang, Y. Yuan, X. Ni, X. Han, and F.-Y. Wang, “Blockchain-enabled smart contracts: architecture, applications, and future trends,” IEEE Trans. Syst. Man, Cybern. Syst., vol. 49, no. 11, pp. 2266–2277, 2019.

J. Bauer and B. Bachmaier, “A framework of blockchain technology for green real estate bonds,” 2020, [Online]. Available: https://www.diva-portal.org/smash/record.jsf?pid=diva2:1446215

P. S. Sisodia, V. Tiwari, and A. Kumar, “A comparative analysis of remote sensing image classification techniques,” in 2014 International Conference on Advances in Computing, Communications and Informatics (ICACCI), 2014, pp. 1418–1421.

A. Ekramifard, H. Amintoosi, A. H. Seno, A. Dehghantanha, and R. M. Parizi, “A systematic literature review of integration of blockchain and artificial intelligence,” Blockchain cybersecurity, Trust Priv., pp. 147–160, 2020.

Y. Zhang, F. Xiong, Y. Xie, X. Fan, and H. Gu, “The impact of artificial intelligence and blockchain on the accounting profession,” Ieee Access, vol. 8, pp. 110461–110477, 2020.

S. Gurbanov and F. Suleymanli, “Analytical Assessment of Green Digital Finance Progress in the Republic of Georgia,” in Green Digital Finance and Sustainable Development Goals, Springer, 2022, pp. 205–222.

A. Reyna, C. Martín, J. Chen, E. Soler, and M. Díaz, “On blockchain and its integration with IoT. Challenges and opportunities,” Futur. Gener. Comput. Syst., vol. 88, pp. 173–190, 2018.

L. Hang and D.-H. Kim, “Design and implementation of an integrated iot blockchain platform for sensing data integrity,” Sensors, vol. 19, no. 10, p. 2228, 2019.

T. M. Fernández-Caramés and P. Fraga-Lamas, “A Review on the Use of Blockchain for the Internet of Things,” Ieee Access, vol. 6, pp. 32979–33001, 2018.

K. Rabah, “Convergence of AI, IoT, big data and blockchain: a review,” lake Inst. J., vol. 1, no. 1, pp. 1–18, 2018.