Development of Deep Learning based Intelligent Approach for Credit Card Fraud Detection

Main Article Content

Abstract

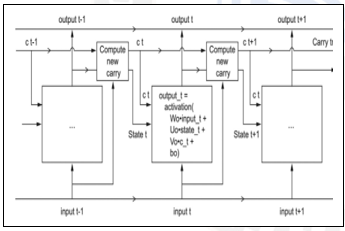

Credit card fraud (CCF) has long been a major concern of institutions of financial groups and business partners, and it is also a global interest to researchers due to its growing popularity. In order to predict and detect the CCF, machine learning (ML) has proven to be one of the most promising techniques. But, class inequality is one of the main and recurring challenges when dealing with CCF tasks that hinder model performance. To overcome this challenges, a Deep Learning (DL) techniques are used by the researchers. In this research work, an efficient CCF detection (CCFD) system is developed by proposing a hybrid model called Convolutional Neural Network with Recurrent Neural Network (CNN-RNN). In this model, CNN acts as feature extraction for extracting the valuable information of CCF data and long-term dependency features are studied by RNN model. An imbalance problem is solved by Synthetic Minority Over Sampling Technique (SMOTE) technique. An experiment is conducted on European Dataset to validate the performance of CNN-RNN model with existing CNN and RNN model in terms of major parameters. The results proved that CNN-RNN model achieved 95.83% of precision, where CNN achieved 93.63% of precision and RNN achieved 88.50% of precision.

Article Details

References

Richard, J. B. & David, J. H. (2001). Unsupervised Profiling Methods for Fraud Detection.london.

Sanjeev, J., Kurian, T., & Christopher, W. S. B. (2011). Data mining for credit card fraud: A comparative study. Decision Support Systems, 602-613.

Richard, J. B. & David, J. H. (2002). Statistical Fraud Detection: A Review. Statistical Science, 235-255.

Chen, T. S., Lin, C. C., & Chen, R. C. (2006). A New Binary Support Vector System for Increasing Detection Rate of Credit Card Fraud. International Journal of Pattern Recognition and Artificial Intelligence, 227-239.

Sahin, Y. & Duman, E. (2011). Detecting Credit Card Fraud by Decision Trees and Support Vector Machines. International Multiconference of Engineers and Computer Scientists (IMECS), 442-447.

Whitrow, C., Hand, D. J., Juszczak, P., Weston, D., & Adams, N. M. (2009). Transaction aggregation as a strategy for credit card fraud detection. Data Mining and Knowledge Discovery, 30-55.

Devi, D. U. & Kalyani, K. R. (2012). Fraud Detection of Credit Card Payment System by Genetic Algorithm. International Journal of Scientific & Engineering Research, 1-6.

Hamdi, O. E. D. M. (2011). Detecting credit card fraud by genetic algorithm and scatter search. Expert Systems with Applications, 13057-13063.

Xin, L. & Haiying, M. (2009). Application of Data Mining in Preventing Credit Card Fraud. International conference on management and service science (MASS), 1-6.

Freisleben, B. & Aleskerov, B. R. E. (1997). CARDWATCH: A neural network based database mining system for credit card fraud detection. Computational Intelligence for Financial Engineering (CIFEr), 220-226.

Duman, E. & Sahin, Y. (2011). Detecting Credit Card Fraud by ANN and Logistic Regression.international symposium on innovations in intelligent systems and applications (INISTA), 15-319.

Carsten, A. W. P. (2008). Credit Card Fraud Detection Using Artificial Neural Networks Tuned by Genetic Algorithms (PhD thesis). Hong Kong University of Science and Technology.

Adebayo, O. A. & Samuel, A. (2017). Oluwadare John O. Awoyemi, "Credit card fraud detection using Machine Learning: A Comparative Analysis. Computing Networking and Informatics (ICCNI), 1-9.

Naga, S., Mannem, P., & Ganji, V. R. (2012). Credit card fraud detection using anti-k nearest neighboralgorithm. International Journal on Computer Science and Engineering (IJCSE), 1035-1039.

Yu, W. F. & Wang, N. (2009). Research on Credit Card Fraud Detection Model Based on Distance Sum. International Joint Conference on Artificial Intelligence, 353-356.

Zareapoora, M. & Shamsolmoali, P. (2015). Application of Credit Card Fraud Detection: Based on Bagging Ensemble Classifier. Procedia Computer Science, 679-685.

Patil, V. & Bhusari, S. (2011). Application of Hidden Markov Model in credit card fraud detection. International Journal of Distributed and Parallel Systems (IJDPS), 203- 211.

Thool, R. C. & Ingole, A.(2013). Credit Card Fraud Detection Using Hidden Markov Model and Its Performance. International Journal of Advanced Research in Computer Science and Software Engineering, 626-632.

Ayse, B. & Ilker, E. E. D. (2013). A Novel and Successful Credit Card Fraud Detection. IEEE 13th International Conference on Data Mining Workshops, 1-10.

Jon, T. S. Q, & Sriganesh, M. (2008). Real-time credit card fraud detection using computational intelligence. Expert Systems with Applications, 1721-1732.

Dominik O. (2014). Fraud detection using self-organizing map visualizing the user profiles. Knowledge-Based Systems, 324-334.

Maarof, M. A. & Abdallah, A. Z. A. (2016). Fraud detection system: A survey. Journal of Network and Computer Applications, 90-113.

Yi?it, K. & Mehmet, U. Ç. (2016). Hybrid approaches for detecting credit card fraud.wiley - Expert Systems, 1-13.

Cody, S., Muyang, S., Stephen, A., & Peter, B. G. R. (2017). Horse Race Analysis in Credit Card Fraud-Deep Learning, Logistic Regression, and Gradient Boosted Tree. Systems and Information Engineering Design Symposium (SIEDS), pp. 117-121.

Djamila, A., Aleksandar, S., & Björn, O. A. C. B. (2016). Feature engineering strategies for credit card fraud detection. Expert Systems With Applications, 134-142.

Patil, V. Nemade, and P. K. Soni, “Predictive Modelling For Credit Card Fraud Detection Using Data Analytics,” Procedia Comput. Sci., vol. 132, pp. 385–395, Jan. 2018.https://doi.org/10.1016/j.procs.2018.05.199

Xuan, G. Liu, Z. Li, L. Zheng, S. Wang, and C. Jiang, “Random forest for credit card fraud detection,” in 2018 IEEE 15th International Conference on Networking, Sensing and Control (ICNSC), 2018, pp. 1–6.

Boracchi, G., Caelen, O., Alippi, C., & Dal Pozzolo, A. (2017). Credit Card Fraud Detection: A Realistic Modeling a Novel Learning Strategy. IEEE Transactions on Neural Networks and Learning Systems, 2162-237X.

Serol, B. & Ekrem, D. Y. S. (2013). A cost-sensitive decision tree approach for fraud detection. Expert Systems with Applications, 5916-5923.

Liu, H. and Motoda, H. (1998). Feature extraction, construction and selection: A data mining perspective, Vol. 453, Springer Science & Business Media.

Zulfiker, M. S., Kabir, N., Biswas, A. A., Nazneen, T. and Uddin, M. S. (2021). An indepth analysis of machine learning approaches to predict depression, Current Research in Behavioral Sciences 2: 100044.

Kumari P, Mishra SP. Analysis of Credit Card Fraud Detection Using Fusion Classifiers. In: Advances in Intelligent Systems and Computing; 2019.

Graves, A. (2012). Long short-term memory. In Supervised sequence labelling with recurrent neural networks (pp. 37–45). Springer.

Kollias, D., & Zafeiriou, S. P. (2020). Exploiting multi-CNN features in CNN-RNN based dimensional emotion recognition on the OMG in-the-wild dataset. IEEE Transactions on Affective Computing.

Masood, S., Srivastava, A., Thuwal, H. C., & Ahmad, M. (2018). Real-time sign language gesture (word) recognition from video sequences using CNN and RNN. In Intelligent engineering informatics (pp. 623–632). Springer.

Zhang, X., Chen, F., & Huang, R. (2018). A combination of rnn and cnn for attention-based relation classification. Procedia Computer Science, 131, 911–917.

Drumond, T. F., Viéville, T., & Alexandre, F. (2019). Bio-inspired analysis of deep learning on not-so-big data using data-prototypes. Frontiers in Computational Neuroscience, 12, 100.

Kar, A. K. (2016). Bio inspired computing–a review of algorithms and scope of applications. Expert Systems with Applications, 59, 20–32.